Difference between revisions of "Payment Gateways"

From Shopnix Help

(→Getting Accurate Pricing Information) |

(→Stripe) |

||

| Line 173: | Line 173: | ||

</div></div> | </div></div> | ||

<div style="margin-top:50px"> | <div style="margin-top:50px"> | ||

| + | |||

| + | |||

| + | == '''What are the benefits of Choosing Stripe Payment Gateway''' == | ||

| + | <div align="justify"> | ||

| + | Choosing Stripe as your payment gateway offers several benefits for businesses. Here are some key advantages: | ||

| + | |||

| + | *'''Easy Integration:''' Stripe provides a developer-friendly platform with robust APIs and documentation, making it easy to integrate into your website or mobile application. The streamlined integration process saves time and effort for developers. | ||

| + | |||

| + | *'''Wide Range of Payment Options:''' Stripe supports various payment methods, including credit and debit cards, digital wallets (such as Apple Pay and Google Pay), ACH transfers, and localized payment methods. This allows you to cater to a diverse customer base and offer convenient payment options. | ||

| + | |||

| + | *'''Global Reach:''' Stripe enables businesses to accept payments from customers worldwide. It supports multiple currencies and allows for international expansion, helping you reach new markets and customers globally. | ||

| + | |||

| + | *'''Seamless Checkout Experience:''' With Stripe, you can create a customized and branded checkout experience that aligns with your website or application. This helps build trust, enhances user experience, and increases conversion rates. | ||

| + | |||

| + | *'''Enhanced Security:''' Stripe prioritizes the security of payment transactions. It is a certified Level 1 PCI DSS (Payment Card Industry Data Security Standard) compliant service provider, employing advanced security measures such as tokenization and encryption to protect sensitive customer data. | ||

| + | |||

| + | *'''Subscription and Recurring Payments:''' If your business offers subscription-based services or products, Stripe provides robust features for managing recurring payments. It simplifies subscription billing, automates payment collection, and handles prorated charges and plan changes seamlessly. | ||

| + | |||

| + | *'''Advanced Analytics and Reporting:''' Stripe offers detailed analytics and reporting tools that provide valuable insights into transaction data, customer behavior, and revenue metrics. This enables you to make data-driven decisions, optimize your business strategies, and improve profitability. | ||

| + | |||

| + | *'''Developer-Friendly Tools:''' Stripe provides a range of developer tools, including testing environments, libraries, and comprehensive documentation. These resources simplify the integration process, enable efficient testing, and assist in resolving technical issues. | ||

| + | |||

| + | *'''Excellent Customer Support:''' Stripe offers dedicated customer support through various channels, including email, live chat, and phone. Their knowledgeable support team is available to assist you with any questions or concerns. | ||

| + | |||

| + | *'''Scalability and Reliability:''' Stripe is built to handle businesses of all sizes, from startups to large enterprises. It offers scalability and reliable payment processing infrastructure, ensuring smooth operations even during high-demand periods. | ||

| + | |||

| + | |||

| + | Choosing Stripe as your payment gateway empowers your business with a secure, flexible, and feature-rich payment processing solution. It enables you to offer a seamless payment experience, expand your customer base, and optimize your payment operations for growth and success. | ||

Revision as of 13:06, 2 June 2023

Contents

- 1 Payment Gateway

- 2 Why do we need Payment gateways for your online store?

- 3 What are the types of Payment gateways do we offer at Shopnix?

- 4 How can one navigate to the Payment Gateway option in the store's admin panel?

- 5 How can one select a payment gateway?

- 6 Razor pay

- 7 What are the benefits of Choosing Razorpay Payment Gateway

- 8 Charges by Razorpay Payment Gateway in India

- 9 Getting Accurate Pricing Information

- 10 Stripe

- 11 What are the benefits of Choosing Stripe Payment Gateway

Payment Gateway

By enabling payment gateway you can make the transactions for a new order in your store.

a payment gateway is a vital component of the online payment process. It serves as a secure intermediary between the customer, the merchant, and the financial institution, facilitating the transfer of funds for online purchases. A payment gateway encrypts sensitive payment information, such as credit card details, ensuring secure transactions. It authorises and verifies the payment details, allowing customers to make purchases seamlessly while providing merchants with real-time payment confirmation. In essence, a payment gateway acts as a bridge that enables the smooth and secure processing of online payments, contributing to a positive shopping experience for customers and streamlined operations for eCommerce businesses.

Why do we need Payment gateways for your online store?

Payment gateways are essential for Shopnix or any e-commerce platform for several reasons:

- Secure transactions: Payment gateways ensure the security of online transactions by encrypting sensitive customer information. They protect the customer's payment details, such as credit card numbers, from unauthorized access, reducing the risk of fraud and identity theft.

- Multiple payment options: Payment gateways enable e-commerce platforms to offer a wide range of payment options to customers. This includes credit and debit cards, digital wallets, net banking, and other payment methods. By providing various options, businesses can cater to different customer preferences and increase the likelihood of completing a sale.

- Convenience and accessibility: Payment gateways make the payment process seamless and convenient for customers. They allow for quick and easy transactions, reducing the friction associated with manual payment methods. Customers can complete purchases with just a few clicks, improving the overall shopping experience and increasing customer satisfaction.

- Real-time transactions: Payment gateways facilitate real-time transactions by processing payments instantly. This allows businesses to receive payments immediately, enabling them to fulfill orders and provide a prompt service to customers. Real-time transactions also reduce the risk of payment delays or errors, leading to improved efficiency in order processing.

- Integration with other systems: Payment gateways can integrate with various business systems, including inventory management, order tracking, and accounting software. This integration streamlines the overall e-commerce operations by automating payment reconciliation, reducing manual effort, and ensuring accurate financial records.

- Trust and credibility: Utilizing reputable and secure payment gateways instills trust and credibility among customers. Shoppers feel more confident making purchases on e-commerce platforms that offer trusted payment options. This trust factor can lead to increased conversions and customer retention.

- Compliance with industry standards: Payment gateways ensure compliance with industry-specific security standards, such as Payment Card Industry Data Security Standard (PCI DSS). Compliance with these standards is crucial for businesses to safeguard customer information and avoid legal and financial consequences.

What are the types of Payment gateways do we offer at Shopnix?

Shopnix offers integration with various payment gateways. The specific payment gateways available on Shopnix can vary depending on factors such as the region, partnerships, and customisation options chosen by the store owner.

- Razorpay: Razorpay is an Indian payment gateway that provides a comprehensive payment solution for businesses. It supports various payment methods such as credit and debit cards, net banking, UPI, digital wallets, and more. Razorpay offers a user-friendly interface, easy integration, and robust security features. It also provides features like smart routing for optimized success rates and comprehensive reporting and analytics.

- Stripe: Stripe is a global payment gateway that enables businesses to accept payments online. It supports credit and debit card payments from customers around the world. Stripe offers a developer-friendly platform with easy integration options, robust security measures, and features like recurring billing, subscription management, and mobile wallet support. It also provides detailed reporting and analytics to track transactions and customer insights.

- PayU Money: PayU Money is an Indian payment gateway that facilitates secure online payments. It supports multiple payment methods, including credit and debit cards, net banking, and digital wallets. PayU Money offers a seamless checkout experience, quick onboarding, and features like tokenization for easy recurring payments. It provides customizable payment pages, fraud detection, and advanced analytics for businesses.

- Direcpay: Direcpay is an Indian payment gateway that enables businesses to accept online payments. It supports various payment methods, including credit and debit cards, net banking, and digital wallets. Direcpay offers a quick onboarding process, easy integration options, and robust security features. It provides features like recurring billing, fraud detection, and detailed transaction reports.

- 2Checkout: 2Checkout is a global payment gateway that allows businesses to accept online payments in multiple currencies. It supports credit and debit card payments, PayPal, and other payment methods. 2Checkout offers a seamless checkout experience, fraud protection, and features like recurring billing and subscription management. It provides comprehensive reporting and analytics to track sales and customer data.

These payment gateways offer a range of features and support different payment methods, catering to the needs of businesses operating in various regions. However, it's important to note that availability and specific features may vary, and it's advisable to refer to the individual payment gateway websites for the most up-to-date and accurate information.

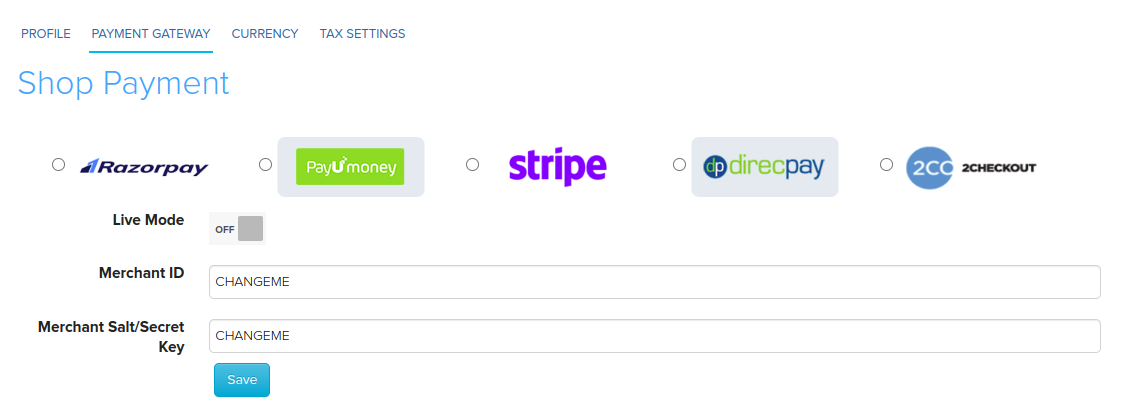

To navigate to the Payment Gateway option in your store admin panel, follow these steps:

Go to ADMIN PANEL > SETUP > SHOP PROFILE > PAYMENT GATEWAY

1. Login to the Admin Panel of your store.

2. Go to the "Setup" section.

3. Locate and click on "Shop Profile."

4. Look for the Payment Gateway option in the menu or toolbar and select it.

Here, you can configure and manage the available payment gateways for your store.

How can one select a payment gateway?

You can select the payment gateway of your choice by clicking on the respective radio button as indicated.

Razor pay

Razorpay Payment Gateway: Simplifying Online Transactions.

Razorpay is a popular and user-friendly payment gateway that simplifies online transactions for businesses. With its range of features and intuitive interface, Razorpay offers a seamless payment experience.

What are the benefits of Choosing Razorpay Payment Gateway

- Multiple Payment Methods: With Razorpay, customers can choose from various payment options such as credit and debit cards, net banking, UPI, and digital wallets. This flexibility allows customers to pay using their preferred method.

- Easy Integration: Razorpay provides hassle-free integration options for developers. Its user-friendly platform offers APIs and SDKs, making it simple to integrate the payment gateway into websites and mobile applications.

- Global Support: Expand your business internationally with Razorpay. It supports multiple currencies, allowing you to accept payments from customers worldwide.

- Recurring Payments: Setting up subscriptions or recurring payments is a breeze with Razorpay. Automate payment collections for subscription-based services and products.

- Smart Routing: Razorpay uses intelligent routing to optimize transaction success rates. It routes transactions through multiple payment processors, increasing the chances of successful payments.

- Top-Notch Security: Your customers' payment information is safe with Razorpay. It employs robust encryption protocols and follows PCI DSS standards, ensuring secure handling of cardholder data.

- Analytics and Reporting: Gain valuable insights into your sales and customer behavior. Razorpay provides real-time transaction data, detailed reports, and analytics to help you make informed business decisions.

- Timely Settlements: Enjoy timely settlement of funds to your account. Razorpay offers scheduled payouts, ensuring you receive your funds on time.

- Customer Support: Whenever you need assistance, Razorpay's dedicated support team is there to help. Reach out to them via email, phone, or live chat.

Charges by Razorpay Payment Gateway in India

The charges by Razorpay payment gateway in India can vary based on factors such as the specific pricing plan chosen, transaction volumes, and payment methods used. While there is no setup fee, Razorpay applies transaction fees for each successful transaction. The transaction fees range from 1.75% to 2.00% for domestic credit and debit cards, 1.00% to 1.75% for digital wallets and UPI transactions, and 1.75% to 2.00% for net banking transactions.

Getting Accurate Pricing Information

It's recommended to visit Razorpay's official website or contact their sales team for the most accurate and up-to-date information on their charges and pricing plans. Keep in mind that Razorpay may offer customized pricing based on unique business requirements or negotiate specific rates for high transaction volumes. By reaching out to Razorpay directly, businesses can discuss their specific needs and get detailed pricing information tailored to their circumstances.

Stripe

Stripe is a widely-used online payment gateway that enables businesses to accept and process payments securely and conveniently. It provides a platform that allows merchants to accept payments from customers via various methods, such as credit and debit cards, digital wallets, and bank transfers. Stripe acts as an intermediary between the merchant's website or application and the financial institutions involved in the payment process.

When a customer makes a purchase, Stripe securely handles the transaction by securely collecting and encrypting the payment details. It then processes the payment and transfers the funds from the customer's account to the merchant's account. Stripe provides the necessary tools and APIs for merchants to integrate the payment gateway into their website or mobile application, allowing for a seamless and smooth payment experience for customers.

In addition to facilitating payments, Stripe offers a range of features and services that enhance the payment process. This includes subscription and recurring billing management, customizable checkout experiences, fraud detection and prevention tools, and comprehensive analytics and reporting capabilities. Stripe's user-friendly interface, developer-friendly tools, and strong emphasis on security make it a popular choice among businesses of all sizes for accepting online payments.

What are the benefits of Choosing Stripe Payment Gateway

Choosing Stripe as your payment gateway offers several benefits for businesses. Here are some key advantages:

- Easy Integration: Stripe provides a developer-friendly platform with robust APIs and documentation, making it easy to integrate into your website or mobile application. The streamlined integration process saves time and effort for developers.

- Wide Range of Payment Options: Stripe supports various payment methods, including credit and debit cards, digital wallets (such as Apple Pay and Google Pay), ACH transfers, and localized payment methods. This allows you to cater to a diverse customer base and offer convenient payment options.

- Global Reach: Stripe enables businesses to accept payments from customers worldwide. It supports multiple currencies and allows for international expansion, helping you reach new markets and customers globally.

- Seamless Checkout Experience: With Stripe, you can create a customized and branded checkout experience that aligns with your website or application. This helps build trust, enhances user experience, and increases conversion rates.

- Enhanced Security: Stripe prioritizes the security of payment transactions. It is a certified Level 1 PCI DSS (Payment Card Industry Data Security Standard) compliant service provider, employing advanced security measures such as tokenization and encryption to protect sensitive customer data.

- Subscription and Recurring Payments: If your business offers subscription-based services or products, Stripe provides robust features for managing recurring payments. It simplifies subscription billing, automates payment collection, and handles prorated charges and plan changes seamlessly.

- Advanced Analytics and Reporting: Stripe offers detailed analytics and reporting tools that provide valuable insights into transaction data, customer behavior, and revenue metrics. This enables you to make data-driven decisions, optimize your business strategies, and improve profitability.

- Developer-Friendly Tools: Stripe provides a range of developer tools, including testing environments, libraries, and comprehensive documentation. These resources simplify the integration process, enable efficient testing, and assist in resolving technical issues.

- Excellent Customer Support: Stripe offers dedicated customer support through various channels, including email, live chat, and phone. Their knowledgeable support team is available to assist you with any questions or concerns.

- Scalability and Reliability: Stripe is built to handle businesses of all sizes, from startups to large enterprises. It offers scalability and reliable payment processing infrastructure, ensuring smooth operations even during high-demand periods.

Choosing Stripe as your payment gateway empowers your business with a secure, flexible, and feature-rich payment processing solution. It enables you to offer a seamless payment experience, expand your customer base, and optimize your payment operations for growth and success.